Central London accounted for the greatest share of total revenue in 2023, at 28%

Photo: Daniel Nouri via Pexels

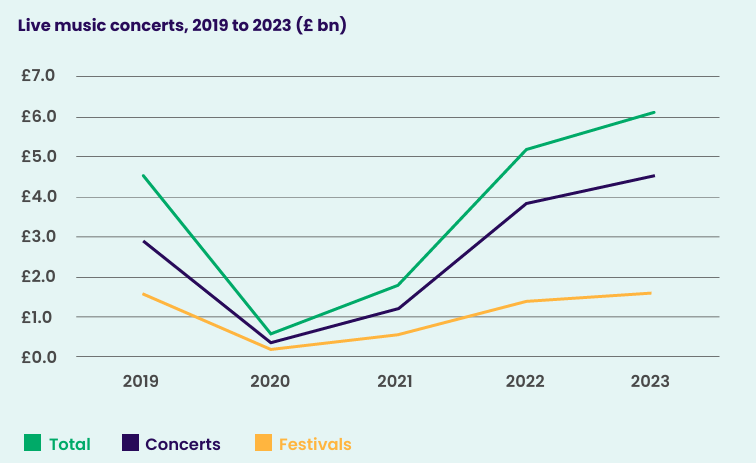

UK live music sector revenue tops £6bn for first time

Research finds growth in total revenue for the live sector has been driven mainly by increased income from concerts.

The total market value of concerts and music festivals in the UK grew by 17% in 2023, reaching a record £6.1bn, despite organisers facing “soaring costs”, research by LIVE (Live Music Industry Venues & Entertainment) and NielsenIQ’s CGA has found.

The figures for 2023 reveal a 35% increase in total revenue for the live sector since 2019, driven mainly by concerts, which experienced growth of 19% in 2023 year on year, compared with 12% for festivals.

Overall, concert revenue increased by 55% since the year before the pandemic, while for festivals, the rise is just 1.2%.

READ MORE:

“Some of this increase was generated by higher ticket prices, which have been inevitable in light of the soaring costs of labour, energy and other key inputs for event organisers," said LIVE in the report.

"However, it is well above the inflation rate throughout 2023 and reflects a strong programme of live events and a steady improvement in consumers’ spending confidence as the year went on.”

In a geographical breakdown, Central London accounted for the greatest share of total revenue, at 28%, followed by Manchester (7.4%), Glasgow (5.5%), Birmingham (3.6%) and Edinburgh (2.2%).

LIVE said that the capital’s dominance was partly due to its relevance on global tour schedules for acts of all sizes and a higher concentration of venues, as well as its relative affluence, which better insulated it from the challenges facing smaller, grassroots venues in a year when 125 closed their doors.

However, when it came to festivals, the UK’s regions performed better, with London taking only 10.6% of revenue while Central England accounted for 23.3%, South West England 15.4% and Lancashire 12.4%.

Source: LIVE

Source: LIVE

The report notes that 36 festivals were cancelled in 2023, with both operators and venue owners sharing that they could not raise ticket prices to the point required to cover costs while simultaneously feeling “blamed” for contributing to rising inflation, which peaked at 11.1% in October 2022.

Conducted in October 2023, researchers found that gig-goers had adapted to a "new normal" with 15% of consumers reporting concerns about COVID at live music events – down from 28% in 2022.

However, cost-of-living pressures also affected attendees, with 16% reporting that they had less disposable income than before. Those aged between 25 and 34 were the most concerned about the total costs of events and tended to wait longer to buy tickets.

Gig etiquette

The research also explored unusual and atypical behaviour demonstrated by audience members at the time as both attendees and venues navigated a return to social situations.

One in five respondents believed that higher ticket prices brought increased expectations, which could lead to tensions if unmet, rising to one in three among 18 to 34-year-olds.

Around a third of all people – and 41% of 18 to 24-year-olds – felt queuing for drinks had become "more painful" than they remembered, and 36% agreed that other people have forgotten how to behave in crowds – rising to 43% in London and 50% among country and metal fans.

A quarter said audiences felt less tolerant, and the same proportion thought they were more easily frustrated, rising to 31% in London and 44% among house fans. One in 10 respondents said they do not think about going to gigs.

Strong numbers

The report also found that in 2023, the UK live music sector supported 230,000 employees, nearly 10% more than in 2019. Of those roles, 49,357 were permanent, a 5% drop since 2019, while casual roles had risen by over 14% since before the pandemic to 158,000.

Jon Collins, CEO of Live, said: “2023 was a year that delivered strong numbers for many elements of the UK live music ecosystem as we enjoyed a full year free of Covid cancellations and restrictions.

“However, it was also a year that saw pressure build across our industry as lingering lockdown habits, a fracturing of supply and demand, the twin cost of living and cost of production crises, soaring interest rates and double-digit inflation all made themselves felt."

Join the Discussion

You must be logged in to post a comment.