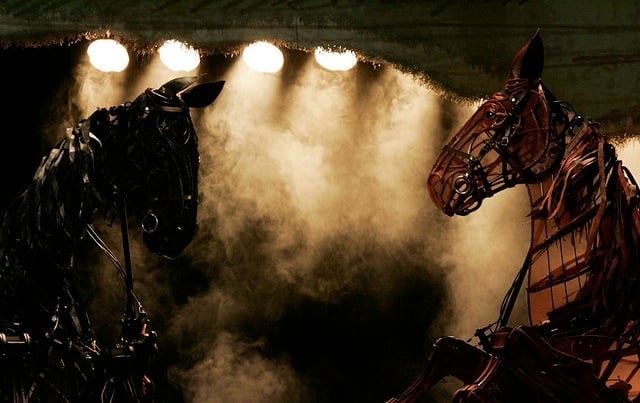

Photo: Eva Rinaldi (CC BY-SA 2.0)

Do we need more distributors of public arts funding, report asks

New research investigating the connections between subsidised and commercial theatre finds a symbiotic relationship with public funding at the heart of its success.

The ‘monopoly’ arts councils and local authorities have over public funding of the arts has been called into question in a new report. “The distribution of public finance relies on only two types of institution: local authorities and arts councils,” writes Author Dr Stephen Hetherington, “it is an open question as to whether this is a good thing or restrictive and disadvantageous to the state’s purposes.”

In his report on the interdependence of public and privately-funded theatre, Hetherington, who is Chairman of HQ Theatres Trust, notes that the two have become “symbiotically interconnected”, and that both are essential to maintaining the size, variety, character, and overall financial strength of the British theatre sector.

Hetherington warns that if subsidy as a proportion of total income continues to decline, producers and theatre operators may be restricted in their ability to take risks. “To some degree this would inevitably change the character of the work produced and presented by theatre companies currently reliant on subsidy,” he writes.

Hetherington avoids making judgement on the comparative artistic value of publicly- versus privately-financed theatre, but does note that some publicly-funded companies see artistic quality as not the primary concern of the private sector – a claim independent producers vehemently deny, saying they set the highest standards. This divide is reinforced through language and operational practices, but Hetherington does not see it as deep-rooted: “These kinds of claims tended to be formed around convenient stereotypes… But, when further explored, views moderated considerably.” The motivators of financial success and artistic quality are universal, he writes, with the only key difference being that non-funded producers may be less able to endure financial loss.

Commissioned by Arts Council England, in partnership with Birmingham Hippodrome and the Theatre Development Trust, the report estimates that the public purse contributes just 14% of total income in the British theatre sector. But this small amount, it says, is key to reducing risk, making experimentation and artistic innovation more possible, supporting the entire industry’s infrastructure and attracting private finance. He points to major subsidised opera and ballet companies that often agree a deal with presenting theatres to split ticket sales, even though their share will equate to far less than their actual costs.

Weighing up the pros and cons of public versus private financing for theatre leads Hetherington to wonder whether the limited supply of, and conditions attached to funding from local authorities and arts councils is too restrictive. He goes on to ask whether more can be done to use subsidy to lever private finance and activity.

The tendency to see the need for subsidy in the sector as proof of market failure is also called into question. Hetherington points out that pre-1945, when Britain’s first arts council was founded, all theatres operated without subsidy. It’s not the market that has changed, he writes, but the transactional elements of demand, price and cost: “The desire to continue to produce and experience certain theatre works might then be better described as super-requirements of the market, desired for national benefit and accordingly purchased with public funds, and not examples of its failures.”

Join the Discussion

You must be logged in to post a comment.